Editor Mike Goodridge introduces Screen’s Australia territory focus.

At the end of March, I went to the closing night screening of the London Australian Film Festival: Rachel Ward’s Beautiful Kate in a double bill with Luke Doolan’s 18-minute short Miracle Fish.

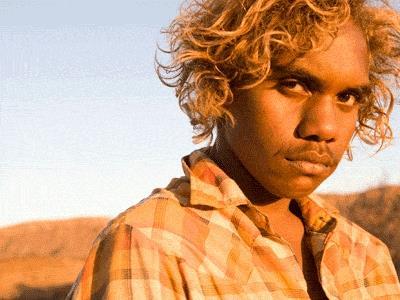

The former had been a festival fixture since its world premiere in Sydney in June 2009 and the latter received an Oscar nomination for live animated short. Both are remarkably assured and unusually profound. They also confirm the richness of local film production in the last year, which saw titles such as Samson & Delilah, Balibo, Mao’s Last Dancer, Bran Nue Dae and Animal Kingdom raise the global profile of the country’s film industry.

Mao’s Last Dancer and Bran Nue Dae also scored well at the local box office, suggesting the miraculous alignment of art and commerce all indigenous industries long for.

Screen’s territory focus looks at the production landscape in Australia in 2010 from both a local and international viewpoint - and the picture isn’t all rosy. Yes, there are successes - Australia has never been short of generating talent and movies on a world-class level. But there are also issues. A national film body, Screen Australia, is valiantly but slowly rising out of the ashes of previous institutions, and the Australian dollar is so strong the stream of international production funds into the country has almost dried up.

There is also, however, a producer’s offset scheme offering qualifying local and international producers a generous 40% slice of budget, and an increasingly lively co-production trade which has yielded films such as The Tree and Oranges And Sunshine. And in companies such as Omnilab Media, there are signs of a growing corporate culture. Omnilab has invested in international titles including W, The Bank Job and The Messenger as well as local ones like Bran Nue Dae and The Loved Ones.

In the additional territory features, our longtime Australian correspondent Sandy George assesses the state of the industry and asks how it could build on its current mini boom.

| AUSTRALIA IN NUMBERS (2008) | |

|---|---|

| Australian population | 22.2 million* |

| Average number of cinema visits per year | 7.3* |

| Average for those aged 14 to 24 years | 9.3* |

| Average for those aged 50+ | 6.9* |

| Number of theatres | 493 (1,980 screens) |

| Cinema capacity | 456,000 seats |

| Number of films released | 301 |

| Number of Australian films | 33 |

| Average cinema price | $10.30 (A$11.17) |

| Total box office and admissions (2009) | $1bn (A$1.09bn), 90.7 million |

| Source: Australian Bureau of Statistics * Source: Val Morgan & Co (Aus) | |

| OFFICIAL CO-PRODUCTIONS WITH AUSTRALIA* | |

|---|---|

| 2009-10 | Arctic Blast (Can), The Last Dragon (Chi), Oranges And Sunshine (UK), Santapprentice (Fr), The Tree (Fr) |

| 2008-09 | At World’s End (Ger), The Boys Are Back (UK) |

| 2007-08 | Bright Star (UK), Goblin Shark Attack (Can), Triangle (UK) |

| 2006-07 | $9.99 (Isr) The Children Of The Silk Road (Chi-Ger) Death Defying Acts (UK) |

| 2005-06 | Elephant Tales (Fr), Gone (UK), Voodoo Lagoon (UK) |

| * Since July 1 2005. Source: Screen Australia. All films listed have gone into production; not all have received final approval as co-productions | |

| INVESTMENT IN AUSTRALIAN FILMS AND CO-PRODUCTIONS | |||

|---|---|---|---|

| Contribution (A$m) | % of total finance | Number of films receiving investment | |

| Contribution from government sources | |||

| 2008-09 | A$35m | 9% | 24 |

| 2007-08 | A$43m | 19% | 20 |

| 2006-07 | A$45m | 17% | 18 |

| Contribution from foreign investors | |||

| 2008-09 | A$224m | 57% | 14 |

| 2007-08 | A$103m | 46% | 11 |

| 2006-07 | A$198m | 73% | 13 |

Source: Screen Australia. The level of foreign investment can vary significantly from year to year depending on whether a big-budget studio-supported film is in the mix. There were two in 2008-09: Legend Of The Guardians; The Owls Of Ga’Hoole and Happy Feet 2. Private investors, including Australian film and television companies, provide the rest of the finance.

| Top five local films | |||

|---|---|---|---|

| Released in Australia in 2009 | |||

| 1 | Mao’s Last Dancer | Roadshow/Hopscotch | (A$15.44m) |

| 2 | Knowing | Icon | (A$7.59m) |

| 3 | Charlie & Boots | Paramount/Transmission | (A$3.86m) |

| 4 | Samson & Delilah | Paramount/Transmission/Footprint | (A$3.19m) |

| 5 | Bright Star | Roadshow/Hopscotch | (A$2.97m) |

| Source: MPDAA. Local films include official co-productions and films classified as Australian for the producer offset | |||

| TOTAL EXPENDITURE ON FILM PRODUCTION IN AUSTRALIA* | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| On Australian films, co-productions and foreign films | ||||||||||||

| Australian films | Official co-pros | Foreign films | All films | |||||||||

| No of films | Total budget | Local Spend | No of films | Total budget | Local Spend | No of films | Total budget | Local Spend | No of films | Total budget | Local Spend | |

| 2008-09 | 29 | A$365m | A$341m | 3 | A$28m | A$17m | 6 | A$10m | A$2m | 38 | A$403m | A$359m |

| 2007-08 | 33 | A$130m | A$121m | 5 | A$93m | A$49m | 7 | A$190m | A$105m | 45 | A$413m | A$275m |

| 2006-07 | 27 | A$220m | A$214m | 3 | A$52m | A$19m | 6 | A$268m | A$105m | 36 | A$541m | A$339m |

| 2005-06 | 29 | A$100m | A$100m | 3 | A$22m | A$13m | 4 | A$36m | A$23m | 36 | A$159m | A$135m |

| 2004-05 | 26 | A$67m | A$66m | 3 | A$45m | A$27m | 9 | A$482m | A$258m | 38 | A$594m | A$351m |

| Annual avge | ||||||||||||

| 00/01-08/09 | 25 | A$151m | A$144m | 3 | A$43m | A$22m | 6 | A$250m | A$133m | 34 | A$445m | A$299m |

| * Since July 1, 2000. Source: Screen Australia | ||||||||||||

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet