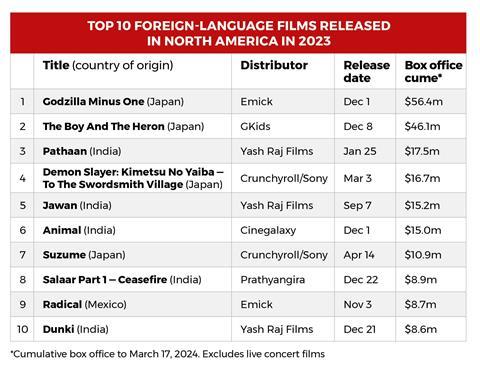

When Hayao Miyazaki’s The Boy And The Heron was named best animated feature at the Oscars last month, it struck a blow for foreign-language cinema around the world at a time when box office and the number of releases is rising. The win did not exactly come out of leftfield given its $46m North American box office, yet the fantasy adventure sent a signal to the industry by snatching the prize from Sony’s much-fanciedSpider-Man: Across The Spider-Verse.

At that same 96th Academy Awards ceremony, Justine Triet’s French mystery drama Anatomy Of A Fall, which has grossed more than $5m in North America, earned the best original screenplay prize for Triet and Arthur Harari, and was nominated in four further categories including best picture and best lead actress for Sandra Hüller.

Jonathan Glazer’s German-language Holocaust drama The Zone Of Interest — a double Oscar winner — has earned more than $8m in North America via A24. Neon is the US distributor of Anatomy Of A Fall and also Wim Wenders’ Oscar-nominated Perfect Days ($3m to date), while The Boy And The Heron hails from Studio Ghibli whose US distribution partner GKids released the film in subtitled original Japanese and dubbed with a starry English-speaking cast.

These are all sizeable enterprises, as are a handful of other veteran US distributors operating in the space such as Sony Pictures Classics, Magnolia Pictures and IFC Films — the latter currently in cinemas with Tran Anh Hung’s French Oscar entryThe Taste Of Things ($2.5m to date). Most foreign-language distributors are smaller, but share a conviction with their counterparts: well-crafted, well-promoted features not in the English language are cultivating broad audiences in the US who are hungry for more.

That said, nobody is pretending it is easy. Competing for eyeballs with Hollywood studios, gradually losing its older audience, and on the whole lacking the pay-1 window deals that boost buying power, all makes distributing foreign-language cinema in the US a tough game.

“It’s extremely challenging,” says Kino Lorber founder Richard Lorber, who has been a mainstay of the foreign-language US distribution arena for years. “It’s a fight to get the visibility for films that need to hold their place in exhibition long enough to gain traction.” Lorber releases around 300 films a year on digital and home video, and 35 to 40 a year theatrically. Opening in New York, thus generating incomparable national press coverage, is vital.

It has become increasingly important to scour the top international festivals. Lorber’s theatrical releases are based on what he calls “pre-curation”: a stamp of approval brought by a Cannes, Berlin or Venice premiere, buoyed by critical praise, and distributed to select exhibitors.

Circuits and venues such as Film at Lincoln Center in New York, which releases new independent cinema and hosts retrospectives and New York Film Festival, see growing popularity among audiences. Florence Almozini, vice president of programming, says less than a quarter of its 43 new releases booked in 2023 were English-language films.

Wherever possible, Almozini and her team arrange in-person presentations by filmmakers, programme a series linked to a release, or show new restorations. “What works is to keep the audience engaged, surprised, curious and able to feel the liveliness of cinema today,” she says.

Younger audiences

Lorber, whose biggest hit last year was Charlotte Regan’s UK comedy Scrapper on more than $200,000, is concerned that the dwindling older audience has not returned in numbers since Covid. “They learned in the pandemic how to use their computers and their Netflix subscriptions,” he says.

Yet this cloud has a silver lining: anecdotally, younger audiences tired of Hollywood storytelling tropes are turning up to watch international films with strong plots or crossover talent, or simply because they get to see shiny new 4K restorations. Lorber has enjoyed recent success with rereleases of Andrei Tarkovsky’s Cannes 1983 best director winner Nostalghia and Bernardo Bertolucci’s 1970 film The Conformist.

Perhaps most significantly, audiences no longer have an aversion to subtitles. Netflix has played a role in this, introducing subscribers to popular local-language series such as South Korea’s Squid Game or Germany’s Dark. “We’ve all been trained to seamlessly process image and text… whether it’s our phone or a computer,” says Lorber. Hearing impairment or the inability of complex cinematic sound design to migrate successfully to the small screen have seen viewers resort to subtitles on English-language film and TV.

Social promotion and event releases have become more prevalent. Cohen Media Group, the distributor owned by US real-estate mogul and fanatic of French cinema Charles Cohen, benefited from a surprise ally on Christian Carion’s dramaDriving Madeleine starring Danny Boon. When Barbra Streisand gave a shoutout to the film — using the French title Une Belle Course — during her SAG lifetime achievement award speech, Cohen’s head of marketing, distribution and publicity Justin DiPietro reached out and Streisand posted about the film on her Instagram account.

DiPietro says the film added $50,000 at the box office after the endorsement (it has launched on digital platforms but remains in a few cinemas). As of March 20, box office stood at $385,000, with $400,000 within its sights. The film would have earned more pre-pandemic, but in today’s terms the executive sees its box office as a win.

On Matteo Garrone’s Italian Oscar nominee Io Capitano, Cohen Media Group has used Letterboxd, the social platform where fans discuss cinema. To promote the Venice Film Festival premiere, Garrone participated in the site’s popular Four Favorites video segment, naming influential features in his life and signing posters for a give-away. “They’ve been good partners,” DiPietro says of Letterboxd, “and they’ve got the audience that we definitely want to tap into.”

Exhibitors like New York City’s IFC Center use the platform too. SVP and general manager Harris Dew courts audiences of all ages through Letterboxd and the major social platforms. “We try to think about what sources that audience pays attention to,” he says.

The scarcity of pay-1 partners for distributors of foreign-language cinema is a major hurdle as the streamers withdraw from the space in search of more widely appealing cinema. Cohen Media Group does not currently have a partner but has struck deals with Mubi, Criterion and streamer/cable networks such as Showtime, with which it collaborated on The Good Boss starring Javier Bardem. The company has a pay-2 deal through the Cohen Media Channel on Prime Video.

Kino Lorber does not have an exclusive output deal with any service but partners regularly with Netflix, Starz, Showtime and Paramount+. After an exclusive theatrical release of typically 60 days, a Kino Lorber film will launch on all transactional VoD platforms and on its new subscription platform Kino Film Collection, where the company has debuted its recent Oscar-nominated documentary Four Daughters by Kaouther Ben Hania….”

GKids, whoseThe Boy And The Heron was still playing in cinemas at time of writing, does not have a pay-1 partner either. However the company, led by president David Jesteadt, has just signed a global streaming arrangement outside the US and Japan for The Boy And The Heron and extended its existing pact on the Studio Ghibli catalogue. The films stream on Max in the US. “Since his last film, the audience familiar with the work of Miyazaki and Studio Ghibli has only increased,” says Jestead, who has kept the filmmaker’s name relevant through the annual retrospective Studio Ghibli Fest, partnering with Fathom Entertainment.

The Boy And The Heron landed in US cinemas on December 8 last year, exactly one week after another prime Japanese export (and VFX Oscar winner), Toho’s Godzilla Minus One, which has grossed $56.4m in North America. Opening weekend for The Boy And The Heron saw a roughly even split between the subtitled Japanese-language and dubbed English-language versions, which moved to 60/40 and then 70/30 in favour of the dub as the run progressed.

Much of the ad spend was on digital platforms such as TikTok and Instagram, where GKids knew audiences would spread the word among their peers. “The general perception of Japanese animation, on the exhibition side at least, is that it often tends to be front-loaded,” says Jesteadt. “We knew we had something the moment we saw the weekday results.”

Jesteadt has enjoyed strong ties with exhibition for years, but concedes the lack of supply stemming from the strike-induced production delays may have played a role in getting access to more in-theatre promotional opportunities. Looking ahead, Gkids wants to work on bigger releases. “For the right film, there’s a very high ceiling as to where these types of stories can go.”

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet