GlobalData’s Media Intelligence Centre looks at analysis of the top performing UK independent films of the past decade to identify strategic patterns for maximising box office figures on a local and global scale.

2023 saw cinema in the UK beginning to resurrect itself from the 2020 pandemic drop, with a 5.5% increase in cinema admissions and a 4% revenue rise from 2022 for all films released in the UK and Republic of Ireland (ROI), grossing £985 million (excluding event cinema). These figures are yet to reach the heights of 2019’s box office boom but illustrate a steady path to recovery.

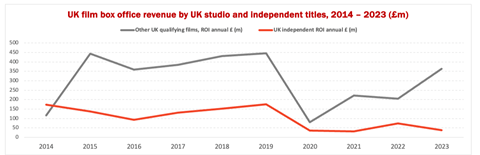

UK qualifying productions, such as big earners Barbie and Wonka, drew in an admirable proportion of this box office revenue—grossing £405.3 million. This is a 31% revenue increase from 2022, in which UK qualifying films earnt £278.8 million. However, UK independent films hardly made a dent in this growth. In fact, with a 2023 UK box office revenue of £37.8m, indie performance dipped 49% from that earned in 2022.

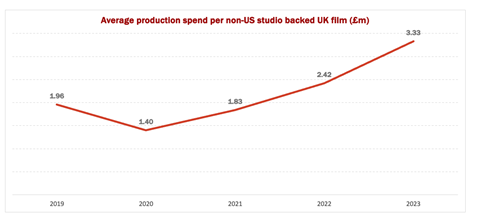

Simultaneously, making independent films is now more expensive than ever in the UK, with rising production costs from the pandemic exacerbated by the cost-of-living crisis and pressures from increased US studio and streamer-backed inward investment films, which create competition for indigenous resources and talent. Though budgets for individual films are not readily accessible, we can see that the average cost per indie production increased by 38% from 2022 to £3.3m in 2023, almost doubling from 2021 levels.

Low box-office figures combined with high production costs mean UK independent film is at a point of crisis.

The UK government has responded to these conditions by announcing on March 6, 2024, that UK-qualifying films budgeted up to £15m can now access enhanced tax relief equivalent to 40% on qualifying spend via the Independent Film Tax Credit (IFTC). A jump from the previous tax credit available, which provided the equivalent of approximately 25% relief, this is a significant move towards both supporting indie films, which typically fall below this lower budget threshold, and helping to get made mid-budget films. The latter cost more than a low-budget arthouse title but less than a studio-backed tentpole.

With new possibilities arising from the increased financial support available for indie films, GlobalData examines how they can best maximise the chance of achieving future box-office success.

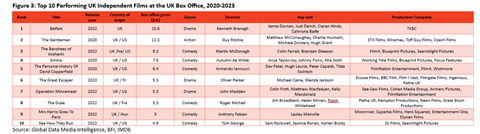

We look at the top performing UK indie titles of the past 10 years to determine the characteristics of pre-and post-pandemic high earners, both at home and internationally, reveal about how the independent film landscape operates, and what its future could look like.

For the purpose of this analysis, we are defining a UK independent film as one that has been majority produced by a UK-based production company and does not have direct creative or financial input from the major US studio companies (NBCUniversal, Paramount Motion Pictures Group, Sony Pictures Entertainment, Walt Disney Motion Pictures Group, Warner Bros Entertainment).

As we indicate in the section below on international co-productions, in an increasingly global market with uneven financial distribution, it is becoming increasingly complex to determine what a UK or independent film is. It is rare to find a film purely produced or financed in the UK. As such, we have limited our definition to ensure that the films we consider have a creative basis in the UK. This differs from the official British Film Institute (BFI) definition for UK-qualifying films, which certifies films based on a variety of factors, from location to cast and language, but doesn’t necessitate a UK creative core. Our list therefore differs from the BFI’s top 20.

With this UK creative basis in mind, we set out to establish the genres in which the top performing UK indie films operate, the talent they feature, the stories they prioritise, and the companies and locations from which they originate, to determine commonalities between past successful box office indie films and how these are standing up in today’s market.

Click here to download the full version of this report, which also investigates genre, talent, co-productions and more within the UK indie space

Maya Marie is a media analyst for Screen International’s parent company GlobalData, a leading provider of data, insights, and analytics for the world’s largest industries. This analysis is an example of the reports that will be created by GlobalData’s forthcoming Media Intelligence Centre, which gives access to sector-specific insights.

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet