The Creative Europe Media programme has long been a cornerstone of the European film industry. But some worry it is now prioritising business objectives over cultural ones — and independent filmmakers are losing out.

For years now, one of the first questions a European distributor has asked when meeting a sales agent repping a film is, “Does it qualify for Media support?”

The question highlights the crucial role the EU’s Creative Europe Media subsidy plays in the distribution of European films within the EU. For distributors buying films, Media’s support schemes such as European Film Distribution and Films On The Move can be “make-or-break” factors, says Thorsten Ritter, EVP acquisitions, sales and marketing of German sales agent Beta Cinema. For a company like Beta, the European Film Sales scheme also provides helpful support for acquiring sales rights to new European non-national works.

Media support extends beyond sales and distribution. Ed Guiney, CEO of Irish-UK producer Element Pictures, notes his company has long benefited from Media funding for its development slate, as well as its exhibition and distribution arms. “It’s been unbelievably important to us,” says Guiney. Years before Yorgos Lanthimos’s Element-produced Poor Things won four Oscars, Media supported the producer with €60,000 ($66,000) to develop Lanthimos’s 2017 film The Killing Of A Sacred Deer, according to figures provided by the Media programme. It provided another €1.3m ($1.4m) in distribution support.

Speak to most European film executives and they will tell a similar story about the importance of Media funding. Robert Heslop, secretary general of the International Federation of Film Distributors’ and Publishers’ Associations (FIAD), calls Media “a precious jewel” that supports the diffusion of European culture and allows distributors to take risks on acquiring and promoting non-national European films to a broad audience. Europa Distribution’s managing director Christine Eloy praises Media support for enabling a “nice diversity of film distributors in each territory who compete for diverse European titles and bring them to diverse audiences”.

Europa Cinemas CEO Fatima Djoumer says the annual €15m ($16.5m) that Media provides to its network of 1,263 independent cinemas to show European films supports the entire film industry chain — from producers and distributors to sales agents.

For Alexandra Lebret, CEO of the European Producers Club, Media is important because it applies to areas not covered by many national film funds, particularly with initiatives such as development slate funding and for the support it provides distributors to buy European films. European Film Promotion managing director Sonja Heinen says Media has played an “absolutely pivotal” role in nurturing and promoting Europe’s audiovisual sector, “contributing to its growth, diversity and global presence.” For training body EAVE’s CEO Kristina Trapp, Media is simply “one of the European Union’s most successful schemes”.

Fact file: Media programme

Origin story: The Media programme was set up in 1991 with the original objective to help films travel beyond their national borders and find new audiences in other European countries. Media is an abbreviation from French: “Mesures pour encourager le développement de l’industrie audiovisuelle”. Its initial budget was €200m ($218m) and, historically, it has focused strongly on the distribution of film. Over the years, its support has grown to encompass areas such as TV series and video games. Media was merged into the EU’s Creative Europe programme in 2014.

How does it fit with Creative Europe? Creative Europe is an EU programme that aims to reinforce European cultural diversity and to increase the competitiveness of its cultural sectors, in particular audiovisual. It has a €2.44bn ($2.66bn) budget for the seven years from 2021-27, with three sub programmes: Media, Culture (which supports all other cultural and creative sectors except AV and film) and Cross Sectoral (which encourages collaboration across sectors).

What is Media’s budget? Media receives the largest share — a minimum 58% — of Creative Europe’s budget. Media’s budget for 2024 is around €186m ($203m). Culture receives a minimum 33% and Cross Sectoral a maximum 9% .

Where does the money go? A share is allocated to support film development through slate development or co-development programmes, but most of Media’s money goes to support the circulation of European content with distribution receiving the largest share. Other recipients include sales agents, exhibitors, markets, festivals, European VoD services and training providers.

What does Media not do? Media does not support film production, but does fund TV production. It aims to complement and fill in the gaps left by film funds of individual EU member states.

Recent examples of Media funding:

- Anatomy Of A Fall (dir. Justine Triet) — €913,000 ($997,000) in distribution support.

- Triangle Of Sadness (dir. Ruben Östlund) — €551,000 ($602,000) in distribution support; €250,000 ($273,000) in film sales support; €1.1m ($1.2m) from marketing programme Films On The Move.

- Alcarràs (dir. Carla Simon) — €56,000 ($61,000) in 2018 for slate development to producer Avalon; €817,000 ($892,000) from Films On The Move in 2022.

- Europa Cinemas, the exhibition network of independent cinemas that screens a significant proportion of European non‑national films — €15m ($16.5m) a year.

- The European Film Awards are supported annually within Media’s Audience Development call, and has received €2.9m ($3.2m) since 2014. Since 2021, Media has also supported the European Film Academy’s Month of European Film and its European film club and young audience award with grants worth €1.4m ($1.5m).

- European Film Promotion, whose activities include film sales support, the Shooting Stars talent programme and promotional activities inside and outside Europe, has received €9.3m ($10.1m) in the 2014-22 period.

Who’s in charge of Media? Media sits within the European Commission’s directorate for communications networks, content and technology (DG Connect), which takes a lead on all things digital and AI. Until the recent European elections, Thierry Breton was the commissioner in charge of DG Connect; the next commissioner is likely to be announced in August.

The director general of DG Connect is Roberto Viola, and the head of unit for the audiovisual industry and media support programmes is Lucia Recalde, who is also a deputy director of DG Connect.

All figures from the Media programme

Media concerns

Hand in hand with this widespread appreciation for Media, there have long been grumblings too. For years, the European industry — while enjoying Media funding — has complained about the bureaucracy of its lengthy application forms and burdensome reporting systems. Many of the forms have repetitive or superfluous sections, while others hardly seem relevant to the particular programme being applied for.

“I understand that it’s public money, but there’s a lot of form-filling and paperwork,” admits Guiney. “It can seem overcomplicated.” Others say they are often left bemused by Media’s decision-making processes for allocating grants. Some admit to turning to AI when filling out the forms.

But concerns about the Media programme have reached a new level of intensity. They have arisen as Media reaches the midway point of its current cycle, which runs from 2021-27. (In the wake of Covid and the UK’s departure from the EU, the current programme secured a 65% budget increase to €2.4bn/$2.7bn compared to the previous cycle, 2014‑21, while also broadening its scope.)

The European Commission is carrying out a mid-term review of the 2021-27 programme, assessing how it has performed. This review will feed into the process of developing the next iteration of Media, starting in 2028.

Amid a cost-of-living crisis and the financial response to Russia’s invasion of Ukraine, many are worried that supporting the cultural and creative industries is falling down the list of priorities for the newly elected European Parliament and its executive branch, the European Commission.

“I don’t see any chance of us getting more money,” worries one executive. “The emphasis should be on defending what we have got and making sure the core elements which benefit the film and AV sector are not degraded.” Others are more optimistic about future Media funding, pointing out that it has one of the smallest budgets of the EU’s funded programmes. In comparison, Horizon Europe, the EU science research programme, has a €95.5bn ($105bn) budget.

Media’s key support schemes

Figures in brackets represent the budget for each scheme for the years 2021 and 2022 combined.

- European co-development (€11m/$12m) Helps to scale up projects by encouraging producers from different countries to work together at development phase.

- European mini-slate development (€9.5m/$10.3m) Targeted at lower capacity countries, supporting the development of minimum two and maximum three works.

- European slate development (€35m/$38.5m) Incentivises production companies to build a portfolio of three to five works.

- Video games and immersive content development (€6m/$6.6m) Supports European video-game producers and extended-reality (XR) studios.

- TV and online content (€36m/$39m) Supports European co-productions by independent producers.

- European film distribution (€63m/$69m) Helps distributors to acquire and promote non-national European works in their territories.

- European film sales (€9.3m/$10.1m) Offers support to European sales agents to acquire sales rights to new European works from producers.

- Innovative tools and business models (€21.1m/$23.2m) A new action that supports innovative solutions to digital challenges, such as financing, visibility, availability and digital consumption.

- Markets and networking (€23m/$25m) Largely to encourage international B2B opportunities through support for audiovisual markets, fairs and campaigns.

- Media 360 (€20m/$22m) A new initiative to support big audiovisual organisations, such as the Cannes, Venice and Berlin film festivals, that impact the whole European audiovisual ecosystem.

- European media talents and skills (€33.1m/$36.1m) To foster the talents and skills of professionals in the audiovisual sector.

- Cinema network (€30m/$33m) Exhibitor members include a high share of European titles in their programming. The sole beneficiary so far has been the Europa Cinemas network.

- Festivals (€9.3m/$10.1m) and networks of festivals (€5.7m/$6.2m) These two schemes take place alternately, every second year. They address festivals that screen a significant proportion of non-national European works.

- Films On The Move (€27.5m/$30m) Supports groupings of distributors, co-ordinated by the sales agent of a title, to implement a common promotional campaign for a premiering European title.

- European VoD networks and operators (€11.8m/$12.9m) Supports VoD services that have a significant share of non‑national European works in their catalogues.

- Audience development and film education (€6m/$6.6m) Mainly supports educational organisations that work with young people to generate interest in audiovisual culture.

- Subtitling of cultural content (€4m/$4.4m) Supports the provision of subtitles covering content in at least three languages on diverse European cultural content.

Sense of continuity

Until very recently, the concerns about the Media programme were of a more existential nature. The possibility of far-right parties dominating the European Parliament was a significant concern ahead of the recent European elections. Many feared such politicians would pressure Media to champion national storytelling and conservative themes in films rather than cultural diversity.

In the end, far-right political parties made some gains in the European elections but did not do as well as anticipated. For now, the nomination of centre-right politician Ursula von der Leyen to once again head the EU Commission hints at continuity.

This sense of continuity was reinforced in July by the election of Nela Riehl as chair of the European Parliament’s influential committee on culture and education (CULT), which supervises the work of the commission including the Media programme. Riehl sits as part of the progressive Greens/European Free Alliance group. Her four elected vice-chairs on the committee all come from left-leaning or centre-right parties. A move by the right-wing Patriots for Europe party to win the CULT chair failed to secure enough votes. “This would have been a disaster,” says one executive.

Concerns about Media are now less about the political impact of the far-right, and more about the overall direction of travel of the programme. Since its launch in 1991, Media has walked a fine line trying to balance two founding aims: to reinforce cultural diversity in the EU, largely by supporting the circulation of European works and fostering co-productions; and to increase the competitiveness of the audiovisual sector.

Many believe Media’s balance is slowly but surely tilting more towards business objectives over cultural ones. In particular, critics think Media wants to foster big European companies that can compete effectively with US giants, rather than independent small and medium-sized enterprises (SMEs). They worry that Media wants to back fewer but bigger commercial European films rather than many smaller arthouse films. Others note the current Media budget might have increased, but it is now spread more thinly: video games, the metaverse and AI have moved up the spending priority list at the expense of Media’s traditional focus on independent film distribution.

In June, in an unprecedented move, a group of influential European film and audiovisual organisations joined forces to sign a letter expressing concern about policy shifts to the Media programme. The 14 signatories included the directors group FERA, the Audiovisual Training Coalition, distributor organisations Europa Distribution and FIAD, sales-agents body Europa International, exhibitor associations Eurocinema, CICAE and UNIC, producers bodies CEPI, EPC and FIAPF, writers groups FSE and SAA, and the International Video Federation.

The letter explicitly accused the Media programme of “drifting away” from its core cultural objectives and instead focusing more on industrial objectives, “benefitting a limited number of large players and the digital transformation with a particular focus on the integration with AI and virtual worlds.” It also argued that Media’s budget is “too limited” to take on additional spending priorities beyond its current essential activities, particularly at a time of persistent inflation.

In a nod to criticism that the commission does not communicate and consult effectively with representatives from the film business, the letter also called for more “regular, transparent and structured dialogue” with the entire industry. (Some have accused the Media unit of only sharing the draft of its annual work programme at the last minute, allowing little time for effective consultation.)

At the heart of the letter lie widespread industry concerns that Media is no longer striking an effective balance between its economic and cultural objectives. Instead of fostering cultural diversity and a mix of large players and SMEs, the letter argues that planned policy changes will support a few European “champions” as well as tech innovations such as AI, XR and the metaverse.

Concerns about changes in direction by the Media programme have rumbled in the background for around 10 years. Many date back to 2014 when oversight of Media was taken out of the European Commission directorate responsible for culture (DG EAC) and moved into the digital and tech directorate (DG Connect).

Eurimages in focus

Eurimages is Europe’s other key cultural fund for independent filmmaking, distributing on average €24m ($26m) a year in support. It is run by the Strasbourg-based Council of Europe, an intergovernmental organisation that protects human rights, democracy and the rule of law. The Council of Europe is not part of the EU institutional setup.

Eurimages was founded in 1989 to promote freedom of expression and cultural diversity through co-operation between independent filmmakers. Eurimages is funded by contributions from 38 European member states (plus Canada) as well as returns on loans granted by the fund.

Eurimages’ main remit is to support co-productions, via a mix of grants and loans. Some 90% of its budget goes to co-production support, and in 2023 it backed 94 films including seven animation titles. It also has support schemes for the promotion of co-production and exhibition.

This means there is relatively little overlap with the Media programme, which focuses largely on development and distribution.

Films recently supported by Eurimages include Cannes favourites All We Imagine As Light, Grand Tour, The Most Precious Of Cargoes and The Shameless.

Key personnel

Recently, DG Connect has been part of the portfolio of Thierry Breton, the influential commissioner for the Internal Market. In the wake of the European elections, Breton has been nominated by France to be its choice again for a European commissioner post, but it is unclear if he will return in the same role. Ursula von der Leyen will announce her commissioner team at the end of August, and the candidates are likely to be ratified by the Parliament in November.

Breton has expressed concern about the dominance of US streaming platforms and the lack of European equivalents, and is viewed as an advocate for Europe’s need for significant homegrown champions. With Media sitting in Breton’s DG Connect directorate, many believe its focus on large players and digital technologies comes from the top.

As a result, some industry executives who want Media to reassert its focus on cultural diversity would like the programme to move back into culture directorate DG EAC. Some fear such a move, however, arguing that DG EAC is not as powerful as DG Connect and might be less effective at securing a budget increase for the next iteration of the Media programme.

There is also plenty of support for the idea that a focus on large media companies is exactly what Europe needs to compete on the world stage. Guiney, whose Element Pictures became part of European production and distribution giant Fremantle Group in 2022, says encouraging scale is “very important” for the future of the European industry.

“One of the things we haven’t quite managed to do in Europe is to grow a number of very substantial European players… the American studios still dominate,” says Guiney, who sees “a lack of ambition sometimes” about the scale of projects supported by the Media programme. “Often it can be about smaller arthouse, which is valid and needs to be supported, but sometimes it is at the expense of bigger-budget stuff.

“Finding ways to be part of the journey of amazing European filmmakers as they grow and make bigger and bigger movies for the world is important, and that is something that hasn’t been cracked.”

Other media executives counter this argument. One, preferring to speak anonymously, tells Screen International: “Media should not be putting public money into commercially viable European films that have no need for public money and that can find it on the market. It is there to fill a gap, where it is hard to build a co-production, to distribute a film in a different language or to support emerging directors from different backgrounds.”

Others say Media funding should continue to be reserved for production companies that are independent from major broadcasters. They believe many of the big broadcasters are lobbying DG Connect for access to Media money. This is coupled with a perception that Breton is happy to meet with the heads of major companies, less so with smaller independents.

“Breton only talks to the big CEOs,” one executive tells Screen. “He is not interested in SMEs that are the driver of cultural diversity. But we think SMEs are the backbone of the industry in Europe.”

Screen asked the Media programme for an interview for this article. Roberto Viola, the director general of DG Connect, was initially put forward for interview but he withdrew at the last minute after receiving Screen’s questions. Instead, the Media unit provided a briefing and a general overview of its work.

In its statement, the Media programme says it has sought to combine cultural diversity and industrial objectives for the last 10 years, and its aim is to continue along this path. “On the one hand, the industry can engage in more ambitious projects, reaching out to wider audiences, only if it is economically robust. On the other hand, if films and TV series are not watched, then they cannot build cultural ties and mutual understanding across borders.”

It gives a couple of examples of how Media underpins these “two mutually supportive objectives.” One is support for Danish start-up Publikum, which combines AI analysis and anthropological research to help independent producers discover which themes and perspectives resonate most with audiences. Another is the Cineville arthouse subscription pass, which is now available in the Netherlands, Belgium, Austria, Germany and soon Sweden. “The passes have boosted engagement with younger audiences,” says Media.

Films are and will remain within its focus, as will cinemas, says the Media programme in its statement to Screen. At the same time, it notes that “many European films do not manage to find their audience”, highlighting that Europeans spend 61% of all streaming time on US films and TV series, and only 8% of their time on content from other European countries. Media also notes that gaming is particularly popular with younger generations, and that European gaming companies can still further grow and scale up.

“The main challenge is to keep up with the pace of digital transformation, which has been exponential recently owing, inter alia, to the use of generative AI.” It notes that its training strand — the talents and skills development support scheme — is being adjusted this year to help professionals “harness digital tools and AI”.

Structure of financing

The Media unit also points to its support for MediaInvest, a €200m ($218m) equity fund designed to encourage private investment and to support commercially ambitious audiovisual projects and companies. Some €70m ($76m) of its budget comes from Media, €70m from the InvestEU programme and €60m ($66m) from the European Investment Fund (EIF). Media says the fund is needed because the European audiovisual sector suffers from a structural lack of private financing. “There is only so much that can be done with grants: companies need more structural solutions.”

MediaInvest aims to leverage €400m ($437m) of new investment for audiovisual production, distribution and the video-games sector. Its first deal was signed last year with French fund Logical Content Ventures.

Some executives have expressed support for Media’s embrace of digital technologies in particular, arguing that AI will transform the film business and that the industry needs to adapt to stay relevant and competitive. But others suggest different EU schemes, rather than Media’s limited budget, should be used to fund such digital initiatives — or that Media’s budget itself should be increased.

“Creative Europe is one of the smallest EU-funded programmes and its schemes are extremely competitive. In the context of the preparation of the next programme, and in view of the rapid increase of costs across the board and other major challenges, increasing its budget would be essential to retain and increase its impact,” says Doreen Boonekamp, ambassador and strategic advisor to the Audiovisual Training Coalition.

“We suggest to make better use of other EU programmes — Digital Europe and Horizon Europe — to specifically support the digital and technological innovations in the film and audiovisual sector,” she adds.

For many, it comes down, once again, to Media striking the right balance between cultural and business objectives. They also want changes to be relevant and align with real industry needs. EAVE CEO Trapp says the training organisation recognises the urgent demand for upskilling audiovisual professionals, especially in new technologies. Doing so, she says, “must rely upon and be integrated into a solid audiovisual ecosystem which is based on a series of cornerstones such as independent company sustainability, visionary leadership, international co- production and global exchange”.

It is clear the Media programme has passionate adherents throughout Europe — but concerns about its direction of travel are acute. What is not in question is how crucial its funding has been for the European film industry, and the desire for it to continue and grow, despite a challenging EU funding backdrop.

“In the broad discussion around the challenges facing the EU’s budget, we need to ensure the Media strand is protected and that support to the film and audiovisual sector remains a key component,” says FIAD’s Robert Heslop. “Not only to support businesses, of course, but also to promote European culture and European culture diversity.”

Case study: Films on the move

The Worst Person In The World

Dir. Joachim Trier

Production country: Norway

Grant: €866,425/$949,960 (Films On The Move, 2021)

Key awards: Cannes 2021 best actress; two Oscar nominations (original screenplay, international feature)

Global box office: €12m ($13m)

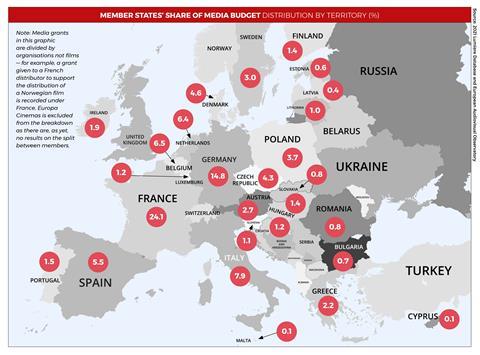

How the Films On The Move marketing grant is split between distributors (by country)

- France €150,000 ($164,000)

- Germany €150,000 ($164,000)

- Italy €103,880 ($113,878)

- Spain €95,987 ($105,226)

- Poland €60,000 ($66,000)

- The Netherlands €40,495 ($44,382)

- Belgium €35,373 ($38,770)

- Finland €30,000 ($33,000)

- Hungary €26,796 ($29,364)

- Austria €26,642 ($29,195)

- Czech Republic €15,050 ($16,450)

- Portugal €13,125 ($14,382)

- Bulgaria €10,000 ($10,960)

- Romania €10,000 ($10,960)

- Slovakia €8,295 ($9,090)

- Lithuania €7,812 ($8,562)

- Serbia €6,485 ($7,108)

- Greece €4,515 ($4,950)

- Estonia €4,270 ($4,707)

- Latvia €4,200 ($4,600)

- Bosnia & Herzegovina €2,723 ($2,985)

- North Macedonia €2,114 ($2,320)

- Montenegro €1,589 ($1,742)

- Sales agent mk2 Films €57,074 ($62,560)

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet