Sony Pictures Entertainment has steered a steady course through the post-pandemic years, and has a new CEO to lead it into the future.

Sony Pictures Entertainment (SPE) is going through a transition of CEO and, while that can portend choppy waters, the studio segment of Japanese titan Sony Group Corporation looks to be on safe ground after seven years with Tony Vinciquerra at the helm. The industry veteran handed over the reins to SPE chairman of global television studios Ravi Ahuja on January 2 and will stay on in an advisory role as non-executive chairman until the end of the year.

That is good news for the company while Ahuja finds his feet in his expanded role. It was Vinciquerra’s cool head that steered Sony Pictures through the pandemic and Hollywood strikes, presiding over four consecutive years of steady revenues. The executive, who joined in 2017, grew the film slate and sold or shut down most of Sony’s 110 cable networks amid the industry-wide decline in linear television.

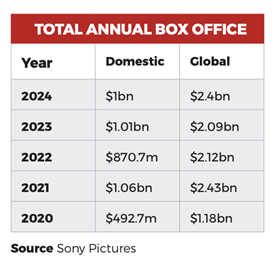

Under the eye of frugal Motion Picture Group chairman and CEO Tom Rothman, SPE enjoyed a satisfactory 2024 at the box office, thanks to the likes of summer hits Bad Boys: Ride Or Die and It Ends With Us, while Venom: The Last Dance performed well in autumn. Bad Boys: Ride Or Die ranked 11th among 2024’s top releases at the North American box office, while It Ends With Us placed 15th, and Venom: The Last Dance ranked 17th. Madame Web, Kraven The Hunter and Here were last year’s box-office low points.

During his tenure, Vinciquerra resisted the temptation to dive wholeheartedly into the streaming arena at a time when all the other studios — and standalone platforms such as Netflix, Amazon Prime and Apple TV+ — were investing huge sums of money into scaling up their direct-to-consumer operations. The executive head avoided that capital-intensive process — although, in fairness, Hollywood’s major streaming businesses appear to be turning a corner and can finally see a path to profit.

Instead, Vinciquerra grew Sony into a strategic supplier of content and struck a pay-1 deal for theatrically released films with Netflix, champion of the streaming wars, further helping the bottom line. The company has dipped its toes into the water, however, and owns the Crunchyroll platform, which serves a dedicated niche audience of anime fans and is available across most of the world bar a few countries, notably Japan, China, Russia and South Korea.

In June 2024, Sony Pictures acquired Alamo Drafthouse, the seventh largest exhibition chain in North America, with 44 cinemas across 25 metropolitan areas. The acquisition will enable the studio to communicate directly with Alamo’s 4million loyalty programme members and “eventise”, to use Hollywood-speak, its own intellectual property (IP). In early January, the first round of redundancies came — reportedly at the behest of Alamo leadership and not Sony — with 15 corporate staffers, or 9% of the workforce, laid off in addition to an unspecified number of staff at its theatres, during the post-holiday slump.

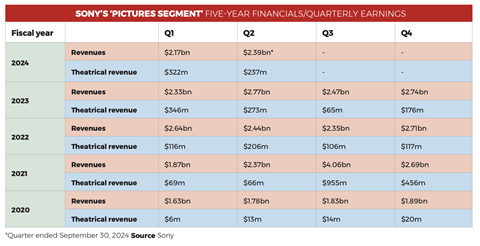

Financial picture

Looking at Sony Pictures Entertainment — aka the ‘Pictures Segment’ — of Sony Group Corporation, encompassing theatrical, home entertainment, television and streaming, revenue in the third quarter of 2024, announced in mid-February, reversed a recent downwards trend in the wake of the 2023 Hollywood strikes and climbed 5.9% year-on-year to $2.62bn.

However profits fell nearly 21% to $223m for the period ended December 31, 2024, which executives attributed to higher marketing costs for theatrical releases. Theatrical revenues climbed 25% to $1.11bn, powered by Venom: The Last Dance.

Since the pandemic, the segment’s quarterly revenues overall have stayed in the $2.4bn-$2.8bn range. Looking at the past five financial years, the biggest success story by far was the third quarter of fiscal year 2021, when Spider-Man: No Way Home was on its way to a final $1.9bn worldwide box office, underscoring the importance of the franchise.

Third quarter streaming revenue from licensed content, driven by the pay-1 deal with Netflix, was roughly flat year-on-year on $363m, and climbed 29.5% in the second quarter to $290m. Going forward, that number will rise or fall on the quality of Sony’s feature film output. Building a sustainable stable of IP is critical.

Sony saw a strong start to 2024, with December 2023 holdover Anyone But You, starring Sydney Sweeney and Glen Powell, playing into the first quarter of the year and earning $221m by the end to become the highest-grossing R-rated romantic comedy worldwide since 2016’s Bridget Jones’s Baby. An $88m North American haul ensured the film became the biggest in the genre since Amy Schumer’s Trainwreck in 2015. Spider-Man spin-off Madame Web, starring Dakota Johnson, opened in February and was a misfire, earning $43.8m in North America and $100m worldwide.

Bad Boys: Ride Or Die opened in June and was one of several tentpoles that kickstarted the summer season after a sluggish start all round. The Will Smith-Martin Lawrence reunion earned $193.3m in North America and $404m worldwide, ranking as the highest-grossing action comedy of the year and propelling the franchise to $1.2bn worldwide.

Blake Lively romantic drama It Ends With Us rounded out the summer on $148m in North America and $349m worldwide to become the biggest female event-film of the year. It was by far Sony’s biggest release of an otherwise slow second quarter that included Fly Me To The Moon, the Apple Original Films romantic comedy that managed $42m. Sony did not pay for production and earned a distribution fee.

Hero worship

Spider-Man remains the jewel in Sony’s franchise crown. Sony Pictures owns the property and 900 related characters in perpetuity, with Disney-owned Marvel Studios and Pascal Pictures producing, and Marvel retaining merchandise rights. October brought the release of spin-off Venom: The Last Dance, starring Tom Hardy, which has gone on to earn $139m in North America and $478m worldwide.

While the lowest-grossing in the three-film series, it was enough to push the overall Venom franchise haul to $1.5bn worldwide. On a reported budget of $120m, break-even and profit came earlier in the film’s cycle.

In December, another spin-off, Kraven The Hunter, starring Aaron Taylor-Johnson and Russell Crowe, opened poorly and by mid-February had earned a dismal $25m in North America and $61.9m worldwide.

The Spider-Man spin-offs are erratic, adding pressure on the core franchise. The three films starring Tom Holland spanning 2017-21 have earned $3.9bn worldwide and fans of the webslinger, not to mention Sony executives, will be pleased to hear a fourth Holland film is on the way.

However it does not open until July 24, 2026 and, while it is anyone’s guess if the actor would want to continue as Spidey after that, the studio will take comfort in a new producing deal with the UK star’s Billy17, struck in December. Sony’s arrangement calls for Holland’s Spider-Man to appear in a set number of Marvel Cinematic Universe films.

Sony Pictures Animation’s two Spider-Verse films have produced close to $1bn worldwide. Spider-Man: Into The Spider-Verse won the animated feature Oscar in 2018, while the second part of 2023 release Spider-Man: Across The Spider-Verse is in the works and, according to reports, could arrive as late as 2027.

After Spider-Man, Jumanji is Sony’s biggest wholly owned franchise, on more than $2.1bn worldwide and counting. The rebooted adventure films continue with a third instalment on December 11, 2026. Four Hotel Transylvania animated features combined have earned more than $1.3bn worldwide (Sony Pictures Animation is in development on a spin-off series for Netflix), and the five Ghostbusters films have earned $1bn-plus (Sony Pictures Animation is in development on a feature and series).

The Karate Kid films have earned $618m and the saga continues with Karate Kid: Legends on May 30, 2025, while five entries in the Insidious horror franchise have amassed more than $500m, with a sixth feature in development. There is a nascent pipeline from PlayStation Productions, which has so far yielded Uncharted in 2022 and Gran Turismo in 2023. Until Dawn, based on the hit horror game, is in post and will open through Screen Gems in April 2025.

Priorities in 2025

The studio needs more world-beating IP to compete with the other studios at the box office. Vinciquerra hinted at this when he discussed last summer’s $26bn all-cash offer by Sony Pictures and Apollo Global Management for Paramount Global, which eventually petered out. Asked why Sony went after the parent company of Paramount Pictures, Vinciquerra told the Financial Times Business of Entertainment Summit in September: “We wanted IP.”

Sony and Legendary are winding down their global distribution partnership, which excludes the Dune and Godzilla franchises and 2025 release A Minecraft Movie, which stayed at Warner Bros.

In streaming and television, the key is to remain a vital “strategic supplier”, as Vinciquerra has put it. Sony has its deal with Netflix, which expires in 2027, and the television studio has delivered multiple hits including Wheel Of Fortune, Shark Tank, The Boys and S.W.A.T.

There is a lot in the theatrical pipeline but the films will need to be great — theatregoers no longer tolerate mediocrity. Working in Sony’s favour is its vocal commitment to the exclusive theatrical window, which pleases the exhibition and creative communities no end. Rothman has been a big advocate of theatrical exclusivity. But how long will the 70-year-old Hollywood veteran stick around before he calls it a day?

Early 2025 has brought the US release of Paddington In Peru, which stood at $31.6m after three weekends since it opened in second place behind Captain America: Brave New World on February 14. The female buddy movie One Of Them Days scored a surprise number two debut on January 17 after seven weekends still ranked in the top 10 on $47.5m – commendable for a reported budget of $14m.

Coming up are Margot Robbie and Colin Farrell in Koganada’s May 9 release A Big Bold Beautiful Journey, which the studio acquired at Berlin’s European Film Market in 2024; Karate Kid: Legends, starring Jackie Chan and Ralph Macchio on May 30; and Danny Boyle’s 28 Years Later, with Jodie Comer, Taylor-Johnson, and Ralph Fiennes on June 20.

A tantalising pipeline includes Darren Aronofsky’s crime thriller Caught Stealing with Austin Butler, and Sam Mendes’s four feature films about The Beatles. The studio is in development on a live-action adaptation of videogame The Legend Of Zelda, produced by Nintendo and Arad Productions.

No comments yet