The year started with industry gloom about a strike-impacted release calendar, but, as Screen reports, the success of Q1 titles — especially for original IP — is bringing optimism to UK operators.

‘Cautious optimism” — that was the buzz phrase on the lips of many exhibitors and distributors at the UK Cinema Association’s two-day annual conference held at London’s BFI Southbank in March. Cautious because of the ripples in the 2024 release slate caused by the Hollywood strikes, but tempered by optimism because of the achieved outcomes for theatrical so far this year.

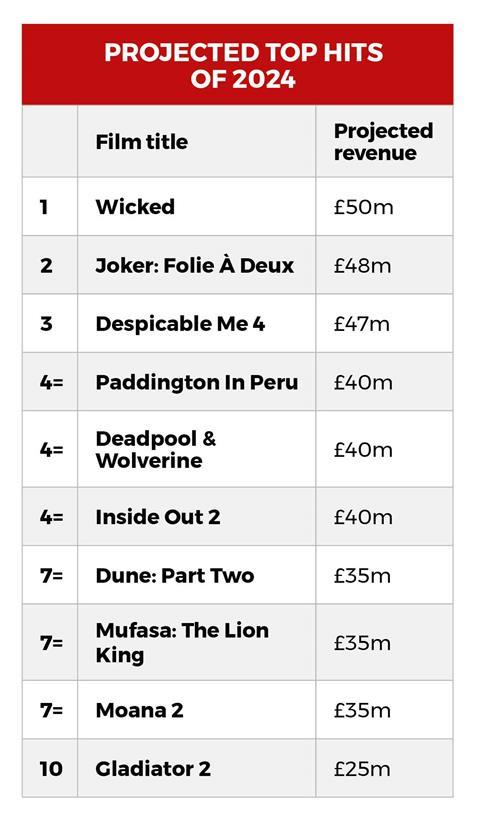

Scroll down for projected top hits of 2024

Before the year began, film tech company Gower Street Analytics’ forecast for UK and Ireland box office in 2024 was £990m ($1.25bn) — a disappointing drop from 2023 (£1.06bn/$1.34bn), and also far behind pre-pandemic 2019’s £1.35bn ($1.71bn) total. More encouragingly, the first 10 weeks of the year produced a UK and Ireland box-office total that is 4% up on the same period in 2023, and Gower Street has now elevated its 2024 forecast to £1.04bn ($1.30bn).

“I think we should be quite buoyed by some of the results that we’ve seen so far this year,” asserts Andy Leyshon, CEO at trade body Film Distributors’ Association, who also lauds “the mix of titles that are working with cinemagoers”, combining “notable big-hitters, but also decent mid-range performers and some quality awards fare — almost back to the rhythm of releases pre-pandemic”.

While the pandemic era has produced four of the 10 biggest hits ever at the UK box office, including 2023 winner Barbie, it is hard to pinpoint any equivalent-sized hits in the 2024 release calendar. Indeed, Digital Cinema Media’s predicted top title for 2024, Wicked, has been pegged by the company at £50m ($63m, see chart opposite). However, as DCM’s content business director Tom Linay points out, nobody was forecasting £95m ($120m) for Barbie or any other 2023 release this time last year, “and there’s absolutely a chance that one of these films takes off”.

In 2023, only six new titles achieved £30m ($38m) at the UK and Ireland box office, and 10 passed the £20m ($25m) barrier. This year, DCM is forecasting nine films to reach £30m, and in addition to the top 10 chart published opposite, Linay reckons the likes of The Fall Guy, Beetlejuice Beetlejuice, Back To Black, John Krasinski’s IF, Sonic The Hedgehog 3 and several other titles all have a shot at reaching £20m. No ‘Barbenheimer’ or Wonka, in other words, but a greater spread of wealth is on the cards.

Strength in depth

Eduardo Leal, group regional director of screen content at multiplex chain Vue, agrees. While cautioning that the total box office for 2024’s top 10 titles may be less than last year, and “there’s no obvious candidate” for a Barbie-size breakout, “it’s clear that the films ranking 11 to 25 will be stronger, including both franchise and original films.”

Leal adds that the company “came to the year cautiously” for the UK and Ireland market because of the strike-impacted release slate, but is buoyed by the fact “everything seems to be working” and “we are ahead of our expectations for the year to date”. Especially encouraging is the success of original-IP titles including Anyone But You (£11.6m/$14.7m), One Life (£9.9m/$12.5m), Wicked Little Letters (£8.2m/$10.4m at press time) and — albeit buoyed by audience familiarity with the subject and song catalogue — Bob Marley: One Love (£16.5m/$21m).

“We are normally cautious with non-IP content in terms of trying to project outcomes, but I see many reasons to be encouraged [for the future] by these results,” says Leal. “Each one of these that connects and works is a strong business case for taking that risk on non-IP.”

Phil Clapp, CEO at UK Cinema Association, is similarly enthused. “It may be that a slightly thinner slate of the familiar franchises does provide space for original stories to find more breathing space. We will only be a sustainable business by drawing in our current audience more frequently, but also by drawing in a broader audience. Stories that are something the audience hasn’t seen before, and makes them want to go back to the cinema, are vital for us.”

Independent market

While the overall UK market has been buoyant, the same can be stated more emphatically for boutique chains Everyman, Picturehouse and Curzon and the whole independent sector — boosted by an awards season that, film for film, exceeded the titles in January and February 2023.

A year ago, the likes of Babylon and The Fabelmans disappointed, and admired contenders including TÁR, The Whale and Women Talking proved tricky commercial sells. This time around, Poor Things, All Of Us Strangers, The Holdovers, The Zone Of Interest, The Boy And The Heron and American Fiction have all delivered, and so have titles that made little or no headway with awards voters: Ferrari (£4.2m/$5.3m), Priscilla (£3.2m/$4.0m) and The Iron Claw (£2.6m/$3.3m).

At Curzon, which operates 16 sites in London and English towns and cities, box office for year-to-date at press time was a very encouraging 41% up on 2023, performing especially well with American Fiction (which Curzon distributed on behalf of MGM Amazon Studios) and A24’s The Zone Of Interest — ranking third and fourth for the year so far at Curzon cinemas behind Poor Things and Dune: Part Two.

For Damian Spandley, Curzon’s managing director for programming and sales, the success is not just about box office — it is also the audience skew. “We’re excited about the growth of our under-25s membership, and we’re hearing similar stories from the independent operators. Films like Saltburn, Poor Things and All Of Us Strangers are bringing in a younger audience, and that’s very exciting for us in terms of the future of our business. Under-25s are embracing arthouse cinema in a way we haven’t seen before.”

The breadth of the market in the first two months of the year should give further encouragement to those operators that rely less on a diet of blockbusters, and to independent distributors. Comscore reported that no fewer than 27 individual titles grossed £1m ($1.3m) in the UK and Ireland across January and February — compared to 21 for those two months in 2023, and 20 in 2022.

Similarly, while the top five titles grabbed a 52% market share in January and February 2023, and 64% for this period in 2022, in 2024 the share for these titles was just 42% — leaving a richer cut of the spoils for the rest of the films on release.

One negative that came out of the UKCA conference was research presented on slate awareness, which showed that in November 2023 31% of cinemagoers surveyed said they had no idea what upcoming films were coming out soon. There was also a perception among exhibitors that studios were spending less on marketing their titles — a suggestion that was rebutted by leading executives from Disney and Warner Bros. Instead, the pattern of spending has changed — and perhaps today’s digital-led campaigns are less visible to cinema operators than bus sides and TV commercials were in the past.

Slate awareness

Clapp was not surprised by the slate awareness data, since it chimed with feedback gleaned at the UKCA’s recent regional meetings. “It’s a familiar refrain, certainly from our smaller operators, that levels of awareness about which films are coming out and when they’re out and who’s in them are low,” he says.

For DCM’s Linay, one challenge in 2024 is the uneven shape of the year, which might make for nervous months ahead, if anaemic box-office data rolls in during Q2. “It feels like the second half of the year is much stronger than the first half,” he explains. “I think the first half of the year has been thinned out by the strikes.” Q4, however, looks a different story, with Joker: Folie À Deux, Gladiator 2, Wicked, Moana 2, Paddington In Peru, Mufasa: The Lion King plus Karate Kid, Sonic The Hedgehog 3 and animation The Lord Of The Rings: The War Of The Rohirrim. Although one or more of these titles may move, “This feels like a slate we might have had in 2018 or 2019,” says Linay. “It’s the first time since the pandemic where a whole quarter looks pretty packed.”

Although that Q4 slate is dominated by existing IP, the films also have potential to seem fresh to audiences: Paul Mescal in Gladiator 2, or Wicked, or The War Of The Rohirrim. “One of the key takeouts from 2023 was the infectious power of originality for audiences,” says the FDA’s Leyshon. “Although based on existing toy IP and a famous life story respectively, you have to say both Barbie and Oppenheimer proved something fresh and different can land with massive success.

“This isn’t to say that we shouldn’t also cherish all of the good existing franchises and IP out there that have delivered so much in recent years,” he adds. “But we should always remember that film is still the youngest of the arts by some distance, and as such there is a real need for new.”

No comments yet