The global box office hit $33.9bn in 2023, up 30.5% compared to 2022, according to estimates from UK data and insights company Gower Street Analytics.

However, takings were still 15% behind the average of the last three pre-pandemic years (2017-2019).

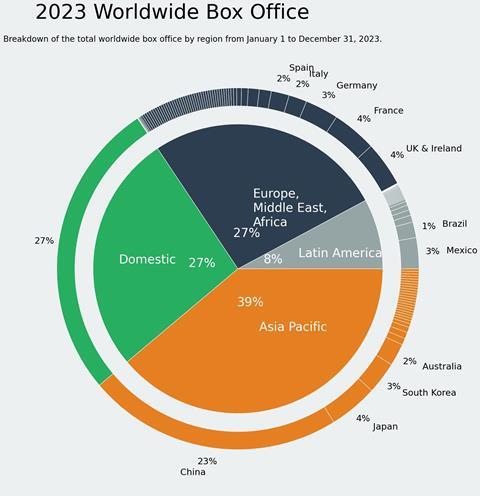

The domestic market remained the top global market with an estimated $9.1bn, accounting for 26.8% of the global result. Domestic takings were up 21% year on year, but still 21% behind the 2017-19 average.

The international market, excluding China, delivered $17.1bn at the box office last year, up 20% on 2022. International box office was down 15% compared to the 2017-19 average.

China’s box office was up 83% on 2022, ending the year on $7.7bn after the December 30 release of Shining For One Thing provided a last-minute boost. These takings are just 6% down on the pre-pandemic average.

Top markets

China led the way for the international markets, followed by Japan on $1.48bn; UK and Ireland on $1.36bn; France on $1.35bn; Germany on $1.01bn; South Korea on $0.97bn; Mexico on $0.94bn; Australia on $0.67bn; Italy on $0.55bn; Spain on $0.54bn; Brazil on $0.47bn; Netherlands on $0.36bn; Russia on $0.33bn; Saudi Arabia on $0.25bn and Argentina on $0.21bn. The results do not include India.

The Netherlands was the only top international market to increase on its 2017-2019 takings and was up 3%.

Box office for Europe, the Middle East and Africa were just shy of $9bn, up 25% on 2022. The region accounted for 26.5% of the global box office but was slightly down on 2022 where it made up 27.7%.

The Asia Pacific region, without China, made a 9% year-on-year increase to $5.5bn though has fallen in overall percentage to 16.1%. With China, takings account for 39%.

Latin America made up 8% of the global box office in 2023, led by Mexico on 3% and Brazil on 1% of the overall total.

Gower Street also recently estimated that the 2024 box office is projected to drop 7% to $31.5bn due in part to a strike-impacted release calendar.

No comments yet