The global box office will rise in 2023, but will still fall short of pre-pandemic levels, according to estimates from UK film tech firm Gower Street.

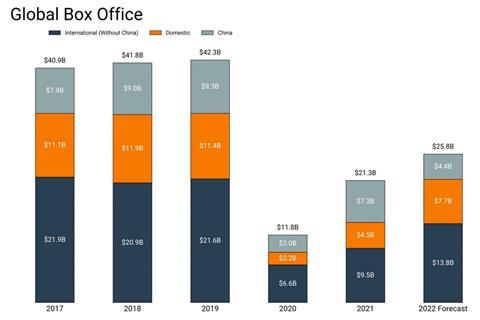

Gower Street predicts that global box office will reach $29bn in 2023, a 12% gain over 2022 if this year remains on course for an estimated $25.8bn global box office. The 12% gain in 2023 will be smaller than 2022’s 21% year on year rise.

If the projection holds, it means the industry will need to wait until at least 2024 to see a full return to pre-pandemic global box office levels.

The 2023 forecast is still 27% behind the average of the last three pre-pandemic years (2017-2019) at current exchange rates. Global box office stood at $42.3bn in 2019.

Key titles launching in 2023 include Indiana Jones And The Dial Of Destiny, Mission Impossible - Dead Reckoning (Part One) and Oppenheimer.

Market by market

The domestic US market is projected to deliver a 12% increase in 2023 ($8.6bn) over 2022 ($7.65bn) but come in 25% behind an average of the last three pre-pandemic years.

The Asia Pacific (exc. China) and Latin America regions are both expected to gain 11-12% on 2022 and come in approximately 20% down on the pre-pandemic average.

The Europe, Middle East and Africa region is expected to increase approximately 7% on 2022 and finish 30% behind the pre-pandemic average. The boycott of Russia is identified as a key reason for the decline here.

China remains the market that is hardest to predict, thanks to a lesser-known advance release calendar, continued uncertainty around access for import titles and changing Covid policy. Gower Street is currently projecting $5.55bn for China, a rise on 2022 but well short of its 2021 figure.

Gower Street said the past year has brought further recovery but also challenges for the global box office.

Key challenges have included a depressed Chinese box office, ending nearly $3bn behind 2021; the Russian invasion of Ukraine and resultant US studio boycott of Russia; an exchange rates rollercoaster ultimately reducing the US$ figure coming from international markets by more than $1bn; and a release calendar with large gaps exacerbated by a host of titles moving out of 2022, removing over $1bn from its domestic estimate.

The projections are calculated using data from Gower Street’s Forecast service and analyst assessment, and are based on the current release calendar. Gower Street stressed that this is a very early prediction and that it would expect to see further changes to the release calendar, and potential unexpected global events, to result in some fluctuation.

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet