Warner Bros Discovery (WBD) Q4 revenues missed Wall Street consensus estimates and fell 1% year-on-year to settle on a shade over $10bn. However the streaming division reported a profit and executives target 150m Max subscribers by the end of 2026.

Streaming revenues climbed 6% against the year-ago period to $2.65bn and the segment turned a profit on $409m compared to a $55m loss a year ago. Direct to consumer advertising revenues climbed 27% year-on-year to $235m.

Max subscribers increased by 6.4m over the last quarter to reach 116.9m. North American membership grew by 4.5m to 57.1m, and international by 1.9m to 59.8m. The 116.9m count compares to 97.7m a year ago.

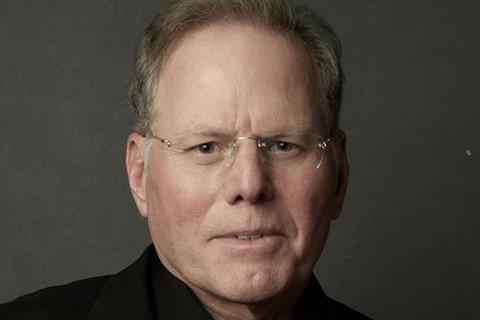

WBD, led by CEO David Zaslav, is rolling out Max internationally and earlier this week announced that the platform will launch in Australia on March 31. The streamer will debut in Germany and Italy in the first quarter of 2026, follwoed by the UK and Ireland.

In a letter to shareholders accompanying Thursday’s earnings report executives said the company has signed a non-exclusive deal to launch on Sky in the UK and Ireland that will bring Max to approximately 10m of their subscribers by the second quarter of 2026.

The studio segment reported revenues of $3.66bn, marking a 15% rise against the year-ago quarter. Theatrical revenues dropped by 9% because of fewer releases in period ended December 31, 2024.

In the letter to shareholders, executives noted a drive towards more modestly budget features alongside the tentpoles, and anticipated the release of Superman on July 11, the first from the restructured DC Studios led by James Gunn and Peter Safran. The executives are overseeing a universe that will feature Supergirl, Lanterns, Batman and Robin, and Clayface, among others.

TV networks revenues fell 4% to $4.77bn, consistent with downward TV revenues at media companies amid the ongoing decline of linear TV.

Overall, WBD generated $2.72bn in operating cash flow and reported $2.43bn in free cash flow.

Shares in WBD climbed 4.8% by the close of trading.

No comments yet