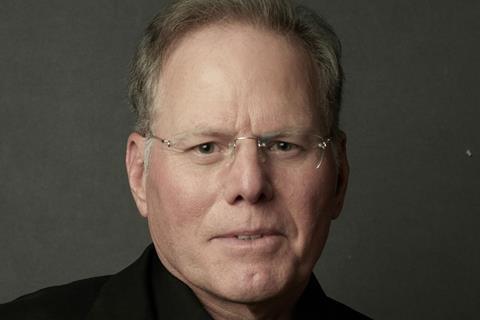

UPDATED REPORT: The $43bn merger between WarnerMedia and Discovery has closed, resulting in entertainment giant Warner Bros Discovery which begins trading on the Nasdaq on Monday (April 11).

CEO David Zaslav has announced his executive suite including Warner Bros Pictures chairman Toby Emmerich and HBO/HBO Max chief content officer Casey Bloys (see below). Warner Media CEO Jason Kilar and WarnerMedia Studios and Networks Group chairman and CEO Ann Sarnoff, among others, have departed.

The company’s goal will be to scale up and take on the might of streaming giants Netflix, Disney+ and Amazon Prime Video, with Apple TV+, which recently won the best picture Oscar for Coda understood to be ramping up aggressively.

“Today’s announcement marks an exciting milestone not just for Warner Bros. Discovery but for our shareholders, our distributors, our advertisers, our creative partners and, most importantly, consumers globally,” Zaslav, who is relocating to Los Angeles, said in a statement.

“With our collective assets and diversified business model, Warner Bros. Discovery offers the most differentiated and complete portfolio of content across film, television and streaming. We are confident that we can bring more choice to consumers around the globe while fostering creativity and creating value for shareholders. I can’t wait for both teams to come together to make Warner Bros. Discovery the best place for impactful storytelling.”

The merger was first announced in May 2021 and the speed in which it has closed has surprised observers.

The new venture’s entertainment assets blend WarnerMedia’s Warner Bros, HBO, HBO Max, CNN, DC Films, New Line Cinema, TBS, TNT, TruTV, Cartoon Network/Adult Swim, Turner Sports and Rooster Teeth (and a share with Paramount in the CW Network) with Discovery’s mostly unscripted brands which include Discovery Plus, Discovery Channel, HGTV, Food Network, TLC, Investigation Discovery, Travel Channel, Turbo/Velocity, Animal Planet, Science Channel and Oprah Winfrey’s OWN.

Under terms of the agreement, which was structured as a Reverse Morris Trust transaction, at close AT&T received $40.4bn in cash and WarnerMedia’s retention of certain debt. Additionally, shareholders of AT&T received 1.7bn shares of Warner Bros Discovery representing 71% of the latter’s shares on a fully diluted basis. Discovery’s existing shareholders own the remainder of the new company.

In addition to their new shares of Warner Bros Discovery common stock, AT&T shareholders continue to hold the same number of shares of AT&T common stock they held immediately prior to close.

ORIGINAL REPORT: David Zaslav has unveiled several members of his key executive suite, fuelling speculation that the $43bn Warner Bros Discovery merger will conclude very soon, possibly by tomorrow (April 8).

According to reports Warner Bros Pictures chairman Toby Emmerich is staying and will report directly to Zaslav, as will HBO/HBO Max chief content officer Casey Bloys, and Warner Bros TV Group head Channing Dungey.

Key Discovery executives include Bruce Campbell, the chief development, distribution and legal officer who becomes Discovery Warner Bros chief revenue and strategy officer. Savalle Sims remains as general counsel and reports to Campbell.

Discovery president and CEO of streaming and international JB Perrette becomes CEO and president of Warner Bros Discovery Global Streaming and Interactive Entertainment, a large remit that encompasses streaming including HBO/HBO Max and Discover+, direct-to-consumer, and gaming.

As previously reported WarnerMedia executives on their way out include WarnerMedia Studios and Networks Group chairman and CEO Ann Sarnoff, WarnerMedia CEO Jason Kilar, HBO Max EVP and general manager Andy Forssell, and WarnerMedia EVP and chief human resources officer Jim Cummings.

No comments yet