Warner Bros Discovery took a massive $9.1bn write-down in the second quarter as the media giant reevaluated its assets in light of the ongoing soft linear TV advertising market and its recent – albeit contested – loss of NBA domestic basketball rights.

Overall revenue dropped 5% year-on-year to $9.7bn, and there was a net loss of $10bn, the company announced in its Q2 earnings on Wednesday.

The direct to consumer segment experienced a $107m loss after posting an $86m profit in the first quarter, and posted revenue of $2.6bn after a 6% year-on-year drop.

Streaming subscriptions over the three-month period ended June 30 increased by 3.6m or 4% to reach 103.3m, with global average revenue per user (ARPU) climbing by 4% to $8, which the company said was mostly due to North American ad tier revenues.

Also affecting the bottom line, the company reported $2.1bn in pre-tax acquisition-related amortisation of intangibles, content fair value step-up, and restructuring expenses.

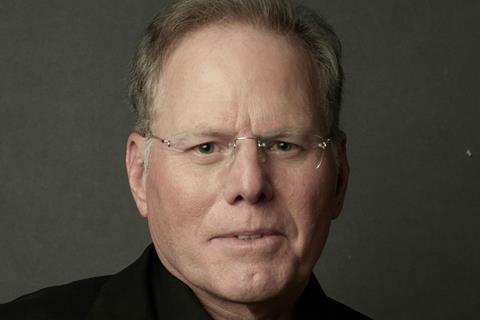

CEO David Zaslav and his team brushed aside speculation of asset sales and splitting up the company. Chief Financial Officer Gunnar Wiedenfels said the focus was on getting the studio segment to “where it needed to be”, and said they were “starting to see the fruits of our labour” in the direct to consumer space.

“We’re a story-telling company that works all over the world,” added Zaslav. “We feel very good about where we are. We have to consider options, but the number one priority is to run this company as effectively as possible.”

Executives also declined to elaborate on one dark cloud, namely the company’s lawsuit with National Basketball Association (NBA) in light of NBA’s decision not to renew the domestic broadcast rights deal with WBD subsidiary TNT.

This means that TNT will not air NBA games after the upcoming 2024-25 season, for the first time in decades. WBD is suing NBA for breach of contract after its right to submit a matching offer as an existing NBA partner was rejected.

The loss of NBA rights dents WBD’s contribution to the new Venu Sports bundle with Disney and Fox, which launches this autumn at a monthly cost of $42.99.

Total adjusted EBITDA reached $1.8bn, marking a 15% decline year-on-year. Cash provided by operating activities decreased to $1.2bn and free cash flow dropped to $976m from $1.7bn in Q2 2023, which the company attributed to lower operating profits and higher net content investment, in part due to the benefit of reduced production costs during last year’s Hollywood strikes.

The studio segment posted revenue of $2.4bn after a 4% decline. Theatrical revenue increased 19%, primarily due to higher home entertainment revenue from Dune: Part Two, and higher box office carry-over by Godzilla x Kong: The New Empire, which opened at the end of March.

Zaslav once again sounded upbeat on the film studio business and looked forward to the September release of Venice opening film Beetlejuce Beetlejuice. Venice selection Joker: Folie a Deux opens in October.

According to data company Parrot Analytics, HBO’s prequel property House Of The Dragon is the number one show worldwide across all platforms since the Season 2 debut and has increased demand for Games Of Thrones on Max.

The DC Universe is in the process of a reboot and the first feature on the roster is James Gunn’s Superman in 2025. Before then, The Penguin series will debut on Max next month.

Having launched Max across parts of Europe in Q2, the expectation is increased international subscription revenues – including from Latin America, where the platform launched earlier this year – will help the bottom line at the direct to consumer business in the months ahead.

Stock fell around 8% in after hours trading from a $7.71 start. WBD stock has dropped by around 68% since the WarnerMedia and Discovery merger in April 2022.

!["Within two weeks [of moving to Northern Ireland] I met Kneecap, the biggest caners in Belfast," says Peppiatt](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/5/3/9/1442539_kneecap1creditpeadarogoill_298103.jpg)

No comments yet