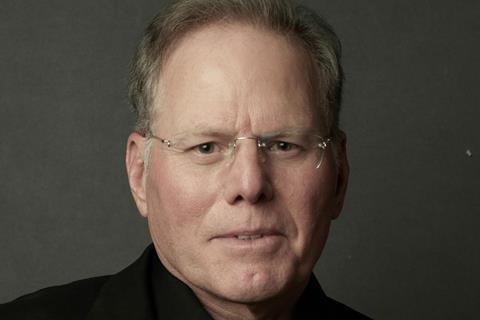

Warner Bros Discovery (WBD) president and CEO David Zaslav said during a Q1 earnings call on Friday that he expected the company’s US streaming business to be profitable in 2023, one year ahead of schedule.

The company reported $50m profit in EBITDA for the streaming operation, a timely turnaround in light of losses in prior quarters. Zaslav told analysts in a post-earnings call that this meant the US steaming business was no longer “bleeding” and stressed that driving down churn – a euphemism for subscribers who quit the service – was a priority.

The overall direct-to-consumer subscriber count, comprising mostly HBO Max and Discovery+ members, increased from last quarter by 1.6m to 97.6m. The two platforms are being combined as Max and the single service is scheduled to launch in the US on May 23, followed by international roll-out.

Streaming revenue reached $2.46bn, a 1% decrease on the year-ago quarter. Advertising revenue grew by 29% driven chiefly by subscriber growth on ad-supported tiers, while content revenue dropped 16% due to lower third-part licensing of HBO content.

Overall financials were disappointing as WBD reported a $1.069bn net loss compared to a $456m profit in the year-ago quarter. Shares dipped before rallying by several points by mid-afternoon.

Zaslav has said the worst of the restructuring since last year’s $43bn acquisition of WarnerMedia is behind it and the company is aiming to shave off $4bn in costs post merger.

WBD revenues for the quarter came in roughly as expected at $10.7bn marking a 5% year-on-year quarterly drop. There was a loss of 44 cents per share – analysts had forecast a loss of 5 cents – compared to a 69 cents per share profit in the year-ago period.

The company ended the quarter with $2.6bn of cash on hand and $49.5bn in gross debt, one quarter of which matures in the next three years. It lost $930m in free cash flow which it attributed mostly to interest payments and sports media rights payments.

Turning to the studio segment, quarterly revenue of $3.21bn dropped 7% against the year-ago quarter. Theatrical revenue was lower than a year ago when The Batman excelled. Operating expenses came to $2.6bn, down 2% on Q1 2022.

Zaslav is a fervent supporter of theatrical and is pinning his hopes on DC Studios led by James Gunn and Peter Safran – he said Gunn has turned in the first draft of Superman: Legacy – and Warner Bros run by Mike De Luca and Pam Abdy.

In gaming, the company said the Q1 launch of Hogwarts Legacy was the largest release of all time for Warner Bros. Games.

Zaslav did not talk about the impact of the writers’ strike during the call, however earlier in the day appearing on CNBC’s ‘Squawk Box’ he said, “In order to create great storytelling we need great writers. We need the whole industry to work together and everybody deserves to be paid fairly.

“Our number one focus is let’s try and get this resolved, let’s do it in a way that writers feel they are valued, which they are, and they’re compensated fairly and then off we go. Let’s tell great stories together.”

On Thursday Paramount Global stock plunged more than 25% after the company announced weak Q1 results and missed analysts’ earnings and revenue forecast.

![The Brightest SunScreen[Courtesy HKIFF]](https://d1nslcd7m2225b.cloudfront.net/Pictures/274x183/3/5/0/1448350_thebrightestsunscreencourtesyhkiff_312678.jpg)

No comments yet